Seeking Out Liquidity

Let Cboe Europe be your guide to navigate any market

A Suite of Innovative Equities Trading Services

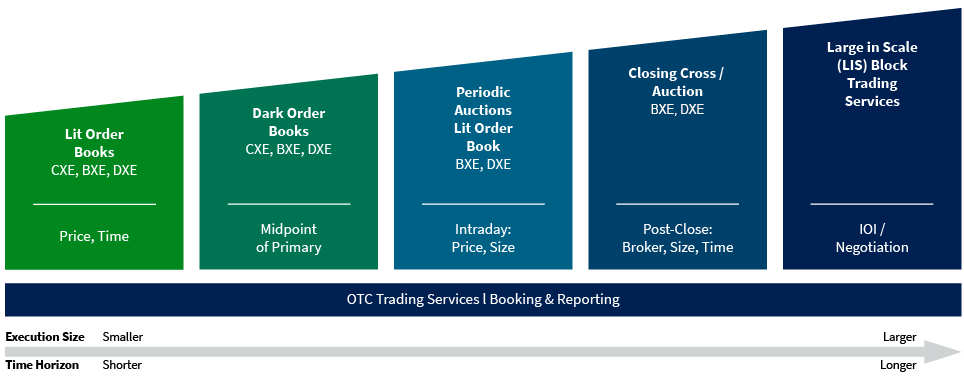

Through our exchanges in the UK and the Netherlands, Cboe UK and Cboe NL, Cboe Europe provides a suite of equities trading services and solutions to meet the diverse needs of market participants. Cboe Europe offers access to 18 major European markets, more than 6,000 securities, multiple pools of liquidity at attractive price points, and services for each stage of trading all through one network connection.

We've always maintained at Cboe that our job is to allow our participants to trade in the way that best suits them and we offer different liquidity pools to meet diverse trading needs.

Order Books: Lit + Dark

Deep, liquid continuous markets

Our exchanges (Cboe UK and Cboe NL) both offer lit order book and dark order book trading. Whether you are looking for fast execution, or midpoint trading, our integrated order book offering enables market participants to execute their trading strategies efficiently.

Periodic Auctions Book

Lit book dedicated to intra-day auctions

The Periodic Auctions book is a lit order book that independently operates frequent, randomized intra-day auctions. Because of the nature of the periodic auction and attributes of the order book, information leakage is minimized and larger orders are prioritized in the auction process.

Closing Cross (3C)

Simple, cost-effective post-close trading service

Cboe Closing Cross is a seamless, one-stop solution for customers looking to execute their post-close trading activities across the 18 European markets that Cboe serves.

Cboe BIDS Europe

Innovative block trading platform

Cboe BIDS Europe is an indication of interest (IOI) negotiation and execution platform allowing market participants to trade large blocks of European equities without revealing their IOI to the wider market.

Cboe BIDS VWAP-X

First-of-its-kind trajectory crossing service

Cboe BIDS VWAP-X is an exchange-operated, trajectory crossing service for European equities, allowing participants to source and match liquidity at an interval-VWAP trade price as part of a bilateral negotiation workflow.

OTC Trading Services

Services for booking and reporting trades

Cboe Europe's suite of Trade Reporting Services enable firms to fulfill a range of business and regulatory requirements including on-exchange off-order book trade reporting with optional clearing services under the ETR services, as well as APA services for MiFID II.

Liquidity Provider Program

The Cboe Europe Equities Liquidity Provider Program (LPP) has been designed to ensure deep liquidity on Cboe Europe's integrated order books.

Other Services

Safeguards and web tools to give firms easy, online access to the information they need, when they need it.