Cboe BXTR: Trade Reporting Services

Suite of Services

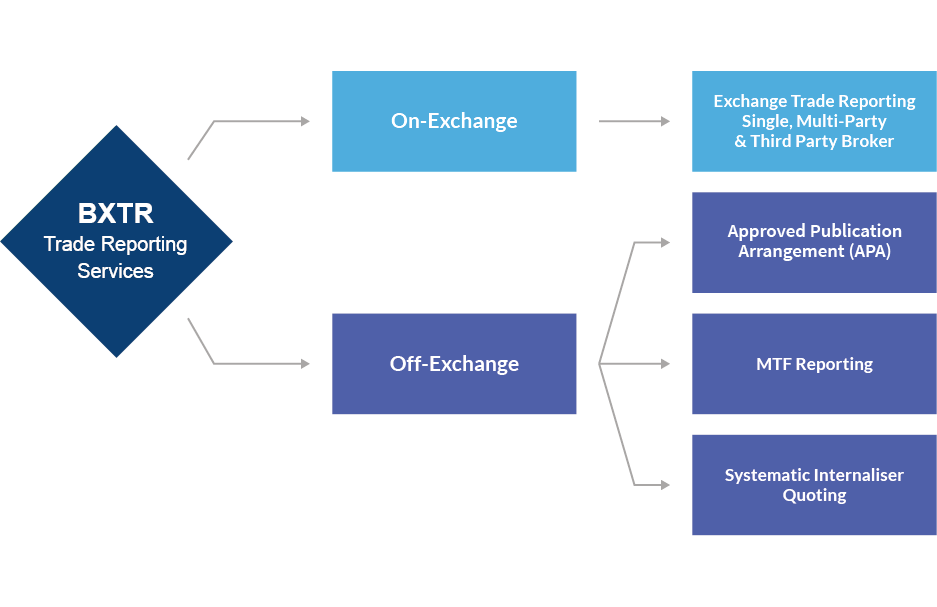

Cboe Europe's (Cboe) suite of Trade Reporting Services is known as BXTR (Cboe Europe Trade Reporting). Cboe aims to promote standardisation of OTC data by supporting the Market Model Typology (MMT) initiative.

The BXTR suite encompasses services that enable firms to fulfill a range of business and regulatory requirements including:

- On-exchange reporting and optional clearing services under the ETR services

- *OTC reporting services in accordance with the MiFID II Approved Publication Arrangement (APA) regime

- Dissemination of MTF trades via Cboe market data to meet post-trade reporting obligations under MiFID II

- Pre-trade transparency quoting in accordance with the MiFID II SI regime

The diagram below illustrates the suite of services on offer.

How to Go Live

Cboe BXTR is Europe's leading solution for on and off-Exchange services.

Please also see our Document Library for a list of all other agreements, price lists, specifications and manuals you may need. If you would like help through the application process, please contact our Sales team at [email protected] or +44 20 7012 8906.

Detailed below are the steps existing and new Participants need to undertake in order to utilise the Services.

Note: The steps set out below can be completed separately or in parallel.

-

Step 1: Documentation

Begin by reading the Service Description, which describes the suite of Trade Reporting Services, and the Off-Exchange Services Tariffs document.

Next, complete and sign the following documents and e-mail them to Participant Services.

- Participants - Participant TRS Addendum

- Non-Participants - Non-Participant TRS Terms & Conditions, Non-Participant TRS Application

For more information on Step 1, please contact Participant Services.

-

Step 2: Connection

New applicants must gain connectivity to our platform. Existing Participants can utilise existing physical connectivity, subject to available bandwidth.

Firms can connect to Cboe Europe Equities (Cboe) directly or via a service provider. To learn about connectivity to Cboe, click the documents below.

- Connectivity Manual - network connectivity options

- Additional circuit delivery details are available upon request. - Inbound FIX Specification - Trade Capture Reports using FIX format

- Outbound Market Data Specifications (optional) - choose between Multicast PITCH or TCP PITCH

If your firm trades via a hosted Service Provider solution, contact your representative and ask them to add Cboe as a destination to your firm's account. View a list of Service Providers that have established relationships.

- Connectivity Manual - network connectivity options

-

Step 3: Testing and Go Live

After your firm's connection has been established and the documentation is in place, you can then commence application testing. Once your own application testing is complete, please contact the Cboe Trade Desk to schedule a certification test.

For more information on Steps 2 and 3, please contact the Cboe Trade Desk.