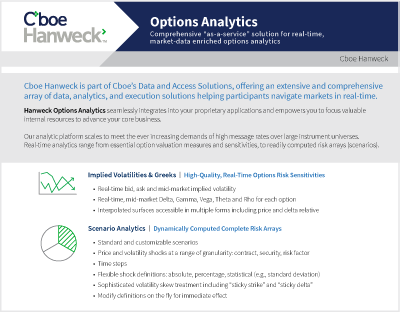

Scenario Analytics

Actionable scenarios for the symbols you need, when you need them.

A fundamental risk management technique is to measure the P&L impact of changes to market conditions. Cboe Hanweck Options Analytics' Scenario Analytics content offers you the ability to see how changes in price, volatility and the passage of time will affect individual securities across the complete universe of listed options and futures. The P&L scenarios for each security are delivered in the familiar form of a data feed. The data feed can be easily combined with in-house risk and position management systems thereby protecting sensitive proprietary portfolio information.

Customizable Scenario Definitions

For each scenario, you can specify different market conditions for individual securities in an easy-to-understand manner.

- Define price and volatility shocks at various levels of granularity – contract, security, risk factor.

- Step forward in time, with user-defined exercise rules.

- Use flexible shock definitions – absolute, percentage, statistical (e.g., standard deviation).

- Sophisticated volatility skew treatment including “sticky strike” and “sticky delta”.

- Modify definitions on the fly for immediate effect.

P&L Vectors

Cboe Hanweck Options Analytics' Scenario Analytics is a customizable set of individual scenarios combined into a vector of profit-and-loss calculations delivered as a data feed. Cboe Hanweck does the heavy computational processing and presents the analytics in a familiar and easy-to-integrate format – just like any other data feed.

- Scenario definitions within a P&L vector can be independently specified for the most flexibility.

- Customize the number of scenarios, the types of scenarios, as well as the magnitude of the scenarios.

- Cboe Hanweck's cutting-edge technology can deliver thousands of customized scenarios for each security in real-time.

Real-Time Margin Forecasting

Most exchange portfolio margin calculations are based on scenario analysis techniques – methodologies such as OCC TIMS® and SPAN® are examples. Cboe Hanweck publishes special-case P&L vectors that conform to many exchange margin methodologies.

- Predict requirements intraday to anticipate potential margin calls later.

- Anticipate broker-specific “house” margin requirements.

Case Studies

TIMS®, STANS®, and OCC® are registered trademarks of The Options Clearing Corporation ® (OCC). OCC assumes no liability in connection with the use of STANS or TIMS by any person or entity. The current version of TIMS or STANS may not be reflected in the Cboe Hanweck services described herein.