Cboe Silexx

Global markets at your fingertips

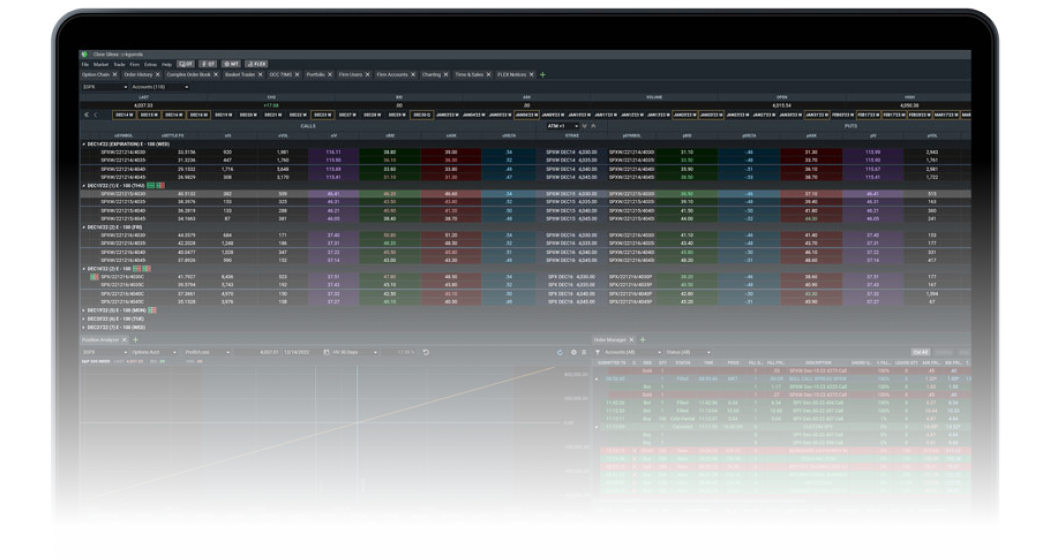

The Power of Cboe Silexx

Cboe Silexx is a world-class order and execution management system. We give you the tools, access and speed needed to be a successful trader or asset manager in today's fast-paced markets. Our multi-broker network gives you access to your most important relationships on the street.

Request DemoOfferings for Professionals

Buy-Side & Sell-Side Solutions

Sophisticated technology to empower individuals and institutions with workflow optimized solutions.

Execution. Analytics. Risk Management

The three pillars of successful market interaction, consolidated and packaged by Cboe Silexx.

Exchange- and Broker-Neutral Network

Seamlessly leverage our diversified broker-neutral routing network to access other exchanges.

Why Silexx?

Technology

Sophisticated patent pending auto-update technology for order entry and staging, accessing a broker-neutral network for algorithmic and direct market access order flow.

Multi-Asset Class

Easily trade equities, options, futures, and options on futures from a single platform – giving you speed to market with powerful order-entry tools.

Trading Tools

Customizable modules to support your trading decisions, including risk controls, auto-order marking and pre-trade analytics.

Extensive FIX Routing Network

Electronically route outbound, or receive inbound, orders and send drop copies.

Regulation Support

Reporting

Customizable, end-of-day reporting, trade allocation and seamless integration with major clearing houses and 3rd-party vendors.

Risk Management

Aggregate firm-wide order flow for an encompassing overview of risk and market exposure for real-time insight and actionable information.

Compliance

A Regulation SCI entity fully regulated by the SEC that offers on-behalf-of reporting for CAT.