NOW LIVE

Tuesday and Thursday

Russell 2000 and Mini-Russell 2000 Weeklys Options

Benefits of Mini-Russell 2000 Index Options

- Certainty of Settlement, No Contra-Exercise Risk

- Cash settled European style options exercise at expiration, unlike American style, which may be exercised OTM after market close — eliminating potential economic and tax risk for writers

- European Exercise

- European style options can only be exercised at expiration, eliminating the uncertainty of early exercise

- Cash Settlement

- Account is credited/debited in cash, there is no delivery of unwanted shares or market exposure

- Covered Margin Treatment

- Receive covered margin treatment on IWM ETF holdings**

- Mini Contract

- Mini-Russell 2000 is 1/10th the size of the standard contract

- 60/40 Tax Treatment

- Capital gains may benefit from 60/40 tax treatment*

A Better Way to Trade the U.S. Small Cap Market

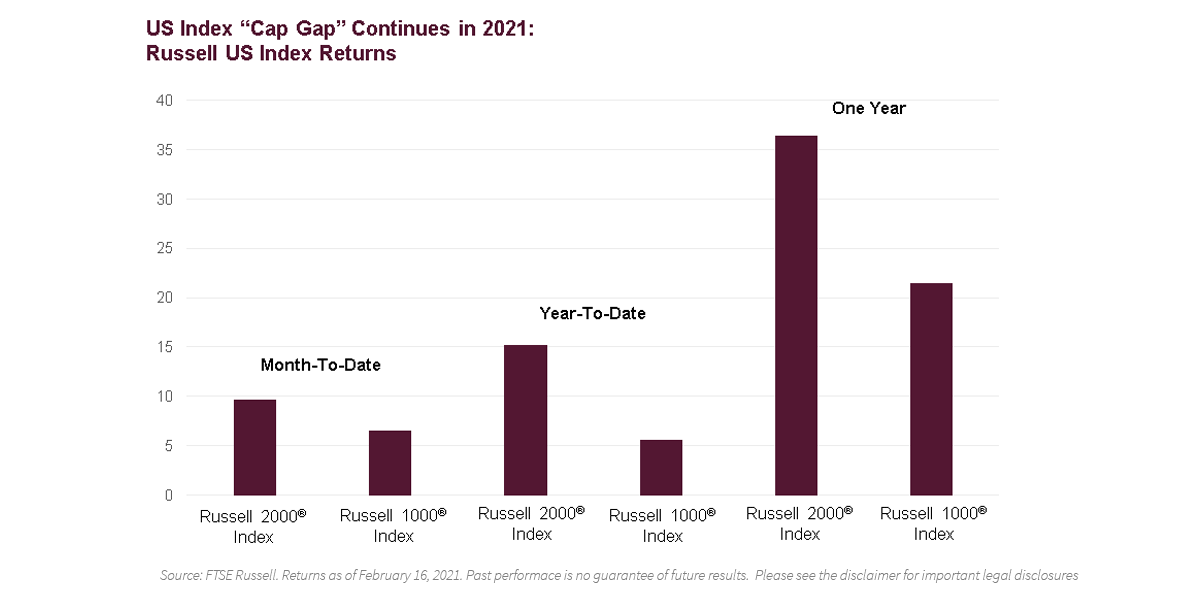

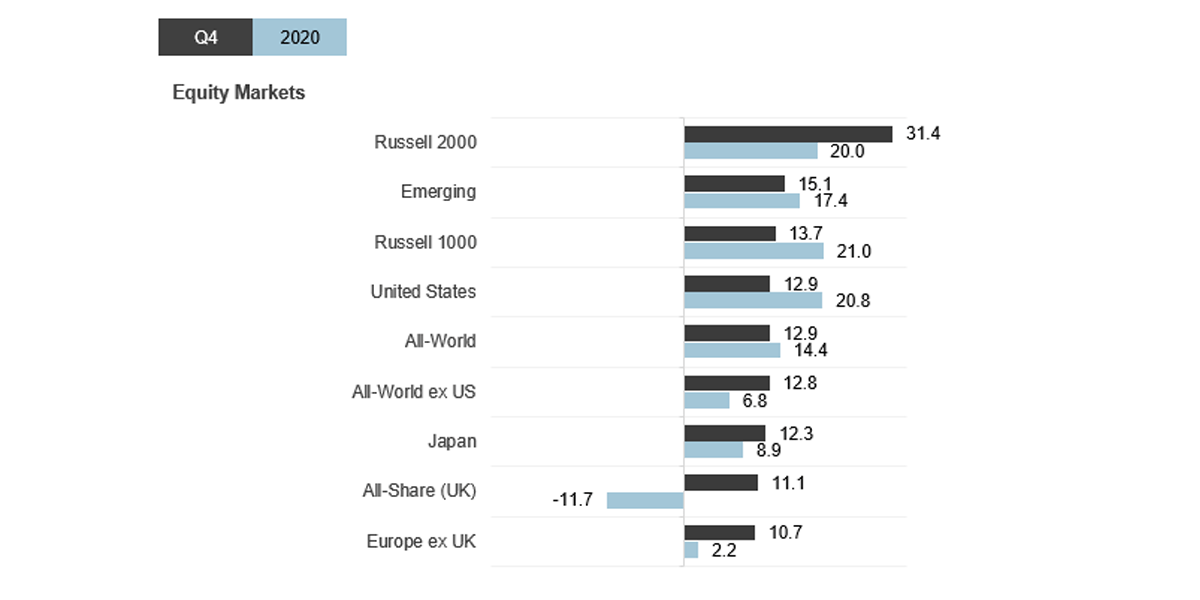

The Biggest Opportunities in Small Caps

Download Whitepaper

Comparing Cboe Minis – MRUT and XSP

The Cboe Mini-SPX option contract, known by its symbol XSP, is an index option product designed to track the underlying S&P 500 Index. This chart shows XSP compared to MRUT, an index option product designed to track the underlying Russell 2000 Index.

Trading Mini-Russell 2000 Index Options

Mini-Russell 2000 Index options will trade on Cboe's Hybrid Trading System, which provides investors with the combined advantages of electronic trading and an open-outcry market on a single platform.

Comparison of Russell 2000 Index Options Products

| Description | Mini-Russell 2000 Options | Russell 2000 Index Options - Traditional | Russell 2000 Index Options - Weeklys and End of Month | iShares Russell 2000 ETF |

|---|---|---|---|---|

| Options Chain | MRUT | RUT | RUT | IWM |

| Root Ticker Symbol | MRUT | RUT | RUTW | IWM |

| AM or PM Settlement | PM-settled | AM-settled | PM-settled | PM-settled |

| Exercise Style | European | European | European | American |

| Settlement Type | Cash | Cash | Cash | Physical Shares of ETF |

Russell 2000 Volatility Index℠ vs. Volatility Index®

The Cboe Russell 2000 Volatility Index (RVX℠) is a key measure of market expectations of near-term small cap equity market volatility conveyed by Russell 2000 stock index option prices. When comparing volatility levels between the Cboe Volatility Index® (VIX® index) and RVX, the RVX typically trades at a higher level than VIX®.

*Under section 1256 of the Tax Code, profit and loss on transactions in certain exchange-traded options, including Mini-Russell 2000, are entitled to be taxed at a rate equal to 60% long-term and 40% short-term capital gain or loss, provided that the investor involved and the strategy employed satisfy the criteria of the Tax Code. Investors should consult with their tax advisors to determine how the profit and loss on any particular option strategy will be taxed. Tax laws and regulations change from time to time and may be subject to varying interpretations.

** Cboe Regulatory Circular RG15-183 notes that Cboe rules allow a short position in a cash-settled-index option established and carried in a margin account to receive covered margin treatment if the short option position is offset in the same account by an equivalent or greater position in an index-tracking ETF that is based on the same index that underlies the short option(s) and provided the investor's brokerage firm has such policies in place.