Read More

FLexible EXchange Options (FLEX® Options) offer customers customizable terms for strike prices, exercise styles and expiration dates with the transparency, administrative ease and clearing guarantees of standard listed options. Since Cboe first introduced FLEX® Options in 1993, interest has grown tremendously – most notably in the first half of 2019.

New Volume and Open Interest Records for FLEX Index Options

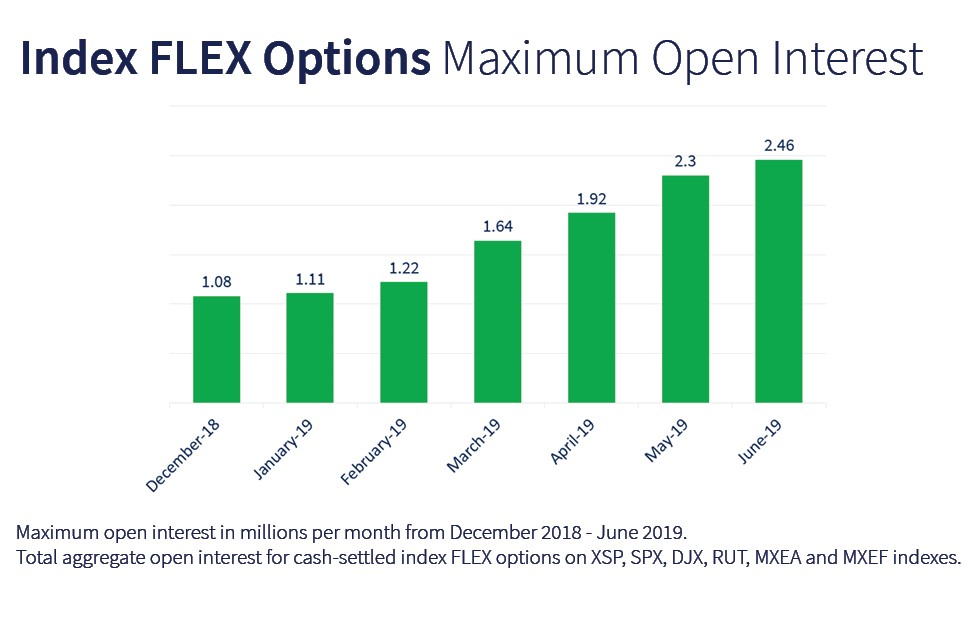

Cash-settled index FLEX Options set new all-time records for open interest and average daily volume in June 2019. Open interest reached 2.46 million (a 122% increase over 1.1 million in January 2019) and average daily volume reached 59,124 (a 402% increase over 11,783 contracts in January 2019).

Features of FLEX Options

Features of FLEX Options

FLEX Options provide investors with:

Index FLEX Options May Be Useful for:

The indexes in the Cboe S&P 500 Buffer Protect Index Series measure the performance of a portfolio of hypothetical exchange-traded FLEX options on the S&P 500 Index, and are designed to provide target outcome returns to the US domestic stock market.

Index FLEX Options with Long-Dated Expirations

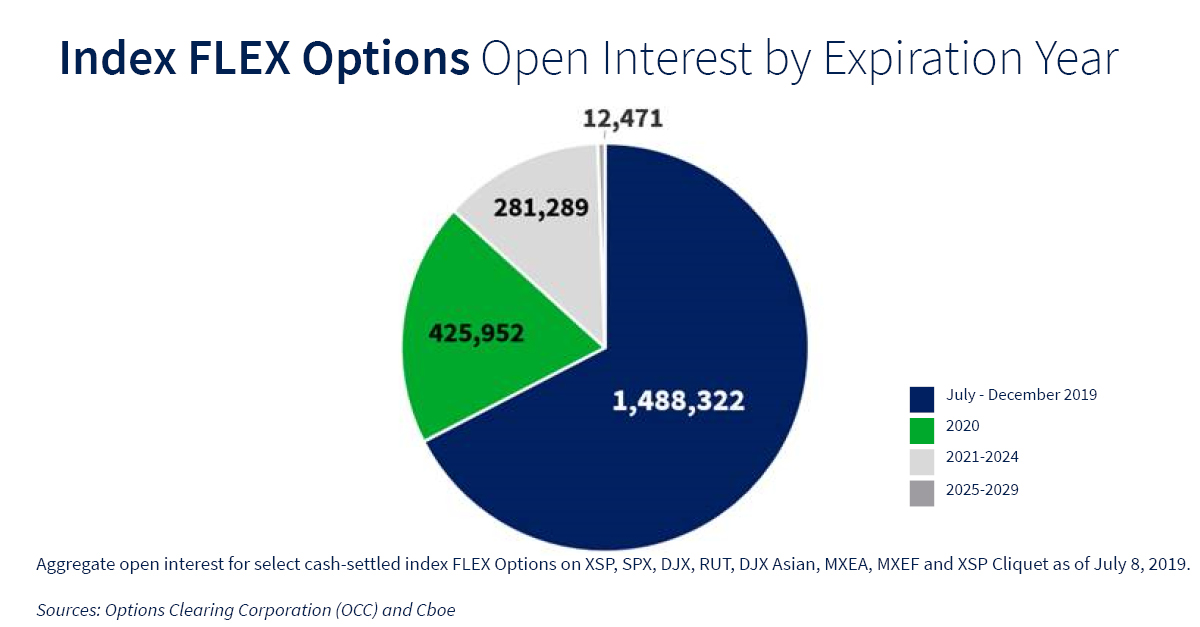

Some cash-settled index FLEX options have expiration dates up to 15 years from the trade date. The chart below shows the open interest by expiration years for key index FLEX options in early July 2019.

There is open interest on cash-settled index FLEX options with expirations in every year from now through 2029. About 13% of the open interest is for contracts that expire between 2021 and 2029. Additionally, there is open interested on the Mini-SPX (XSP), S&P 500® (SPX), Dow 30® (DJX), Russell 2000® (RUT), MSCI EAFE® (MXEA) and MSCI EM (MXEF) indexes, as well as on Cboe listed Dow 30 Asian options and the SPX and Mini-SPX Cliquet options.

More Information

Visit the websites below to learn more about how standard index options and FLEX options can be used in portfolio management.