Read More

I’m thrilled to share some exciting news from the HOOD Summit 2024 in Miami. As recently announced in our press release, Robinhood will soon bring Cboe Global Markets’ index options trading to its customers on its trading platform. This initiative marks a significant milestone in our goal of empowering retail investors and democratizing access to versatile trading tools like options1.

HOOD Summit 2024 has been an incredible event so far, bringing together financial enthusiasts, tech innovators and industry leaders. I’ve thoroughly enjoyed speaking with so many individuals that are truly excited about growing their financial futures.

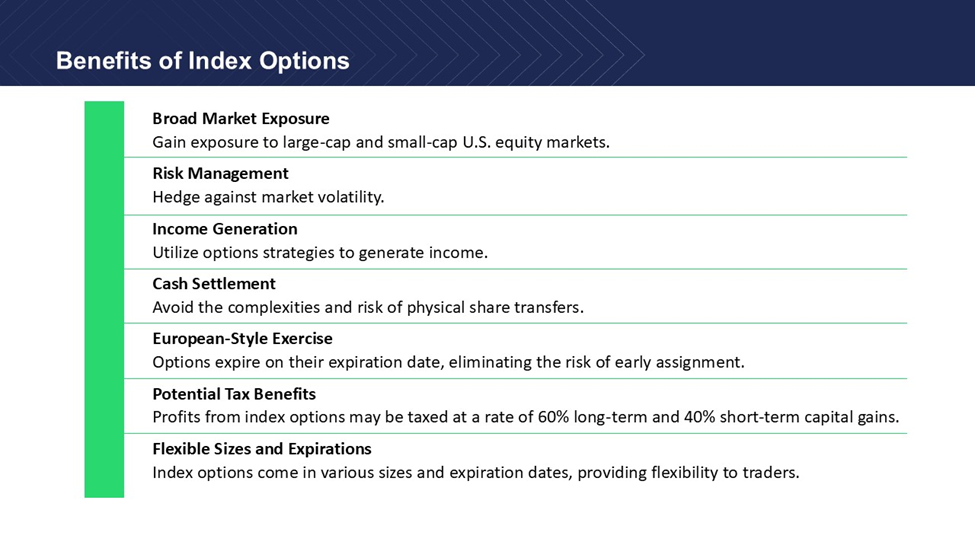

Attendees have not only had the opportunity to chat with financial experts and participate in interactive sessions, but they also gained access to new products and tools. Those in attendance, along with Robinhood customers, will soon be able to trade Cboe’s flagship S&P 500 Index (SPX) options, Cboe Volatility Index (VIX) options, Russell 2000 Index (RUT) options, and Mini SPX (XSP) options on Robinhood’s platform.

Demand for options trading has risen among both retail and institutional investors seeking tools to efficiently manage risk and capture market opportunities. In 2023, total U.S. options volumes exceeded 11 billion contracts, marking the third consecutive year of record volumes and a 126% increase since 2019. Cboe’s proprietary product suite has similarly seen increasing investor participation, with average daily volumes reaching a record high of 4.2 million contracts during third-quarter 2024, up 13% from third-quarter 2023.

Retail investors have come a long way in recent years, growing their financial knowledge and trading experience. At Cboe, we recognize this evolution and are committed to meeting their needs with education and access to our popular and liquid index options.

Cboe’s Commitment to Retail Investors

Cboe’s Commitment to Retail InvestorsCboe CEO Fred Tomczyk discusses empowering retail traders at HOOD Summit.

Innovation and accessibility have always been integral to Cboe’s DNA, keeping us at the forefront of the financial markets. The rise of retail trading has been one of the most significant developments in the financial markets, and we’ve embraced this advancement wholeheartedly. Retail traders have become more comfortable trading equities and are now ready to incorporate options into their portfolios to help protect their investments and potentially grow their wealth.

Cboe display at HOOD Summit showing everything is better with options.

If you’re curious about index options, we invite you to explore the educational resources at Cboe’s Options Institute. Whether you’re just getting started or have been trading for years, The Options Institute has a wealth of educational tools and offerings to help you build the knowledge you need to trade with confidence.

Additionally, Robinhood makes available to its customers through its platform the Cboe Global Indices Feed, which provides real-time index values for products like SPX, VIX and RUT options.

Cboe is deeply committed to building trusted markets across the globe. Retail investors are a significant force in the global financial ecosystem and we couldn’t be more excited to equip this new generation of traders with tools that will further empower their strategies – and their financial futures.

**

1) A number of retail brokerage platforms make Cboe’s proprietary index options available to their customers. Please consult your retail broker for more information.

Options involve risk and are not suitable for all market participants. Prior to buying or selling an option, a person should review the Characteristics and Risks of Standardized Options (ODD), which is required to be provided to all such persons. Copies of the ODD are available from your broker or from The Options Clearing Corporation, 125 S. Franklin Street, Suite 1200, Chicago, IL 60606.

Uncovered option writing is suitable only for the knowledgeable market participant who understands the risks, has the financial capacity and willingness to incur potentially substantial losses, and has sufficient liquid assets to meet applicable margin requirements. In this regard, if the value of the underlying instrument moves against an uncovered writer's options position, the writer may incur large losses in that options position and the participant’s broker may require significant additional margin payments. If a market participant does not make those margin payments, the broker may liquidate positions in the market participant’s account with little or no prior notice in accordance with the market participant’s margin agreement.

Certain risks associated with options, futures, and options on futures and certain disclosures relating to information provided regarding these products are also highlighted at www.cboe.com/us_disclaimers.